A Biased View of Partnership Vs Llc

Develop an LLC Operating Arrangement Even though operating arrangements need not be submitted with the LLC filing office and are rarely needed by state law, it is important that you develop one. In an LLC operating contract, you set out guidelines for the ownership and operation of business (just like a partnership contract or corporate bylaws).

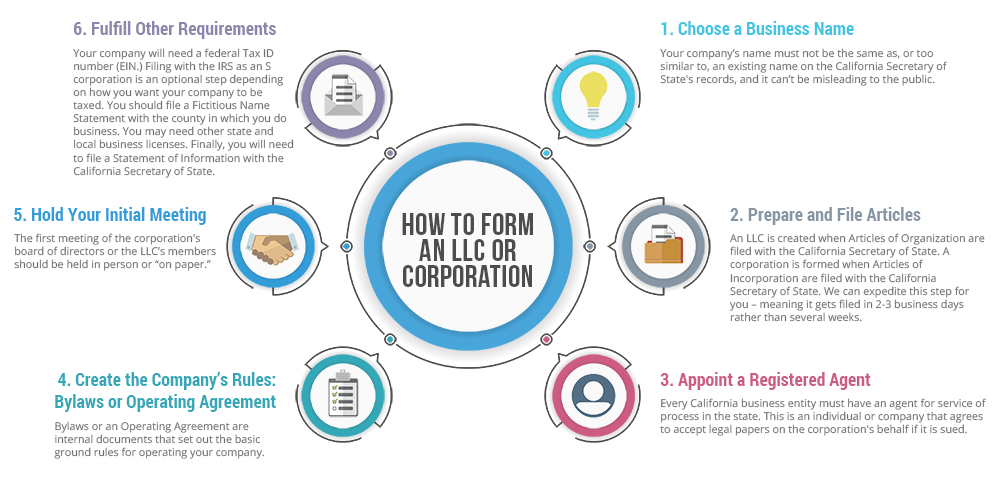

For more on LLC operating contracts, checked out Nolo's post The LLC Operating Arrangement. 4. Release a Notice (Some States Only) In a few states, you should take an extra action to make your business authorities: You must publish an easy notification in a regional newspaper, mentioning that you plan to form an LLC.

Your local newspaper ought to have the ability to assist you with this filing. 5. Get Licenses and Allows After you have actually finished the steps described above, your LLC is official. But before you open your doors for business, you require to obtain the licenses and permits that all new organisations must have to run.

Why Need to You Form an LLC A Limited Liability Company is a business structure formed under specific state statutes. It is a different legal entity from its owners (called "members"). An LLC can be formed as either a single-member LLC or a multi-member LLC and either member-managed or manager-managed.

It uses a few of the very same benefits of a corporationwithout the costs and compliance intricacy. Entrepreneur that are searching for personal liability protection, tax flexibility, and management alternatives might find that forming an LLC (Limited Liability Company) will be a perfect choice for their business. Advantages of Forming an LLC Simplicity Beside operating a company as a sole owner or basic partnership, the LLC structure is the least complex and pricey type of organisation to begin and preserve from a state compliance perspective.

Personal Liability Security Since an LLC is thought about a separate legal entity from its members, its monetary and legal responsibilities are likewise its own. So, if somebody takes legal action against business or the business can not pay its debts, the LLC members are generally not held responsible. For that reason, their individual properties are at lower risk of being seized to pay legal damages or settle debt than they would be if the organisation were a sole proprietorship or partnership.

Partnership Vs Llc - An Overview

As such, income tax is used in the very same way as it is to sole proprietorships and partnershipswith organisation earnings and losses gone through to its members' tax returns and subject to members' specific tax rates. An LLC has other tax treatment options, too. Members can decide for an LLC to be taxed as a corporation, with profits taxed at its corporate rate.

Management Flexibility An LLC might be either member handled or manager managed. In a member-managed LLC, the owners manage the daily management of business. In a manager-managed LLC, members select one or more managers to manage the company. In a lot of states, an LLC can select members of the LLC to be managers, or it can employ another person to do the task.

Many states think about an LLC to be member-managed unless the development documentation shows it needs to be manager-managed. How to Type an LLC File Articles of Company with the State Forming an LLC needs filing Articles of Company with the state in which the LLC will run. Corp Net can sign up an LLC in all 50 states to enable them to save time and moneyand to guarantee their documents are submitted properly.

An LLC is needed to have an EIN to open a bank account, file for licenses and licenses, work with workers, and perform other service activities. An LLC can acquire an EIN free of charge from the Irs. A business can also ask Corp Net to deal with finishing and sending EIN documentation on its behalf.

Even in states that don't require operating arrangements, an LLC (especially one has numerous members) might find one handy for preventing misconceptions about who should be doing what and who has the authority to make sure decisions. Obtain Organisation Licenses and Permits you could try here An LLC may require to have different business licenses and